As part of the updates to Business On Line for Verification of Payee (VOP) and SEPA Instant we have made changes to the way you authorise multiple payments at the same time.

You can authorise a maximum of five SEPA Instant payments at the same time.

Similarly, you can authorise a maximum of five Standard SEPA payments at the same time – a change from the previous limit of ten. You cannot authorise a mix of SEPA Instant and Standard SEPA payments.

You cannot authorise a mix of SEPA Instant payments or Standard SEPA and other payment types.

You can continue to authorise up to a maximum of 10 of the following payment types together at the same time.

- Account transfers

- International payments

- SDMT / CHAPS.

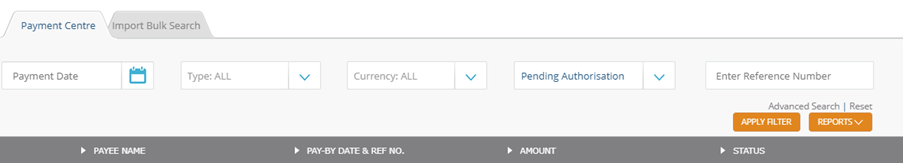

If you want to authorise multiple payments of the same payment type, you can use the ‘Type’ filter in the Payments Centre to make your selection.