Verification of Payee (VOP) bulk file service

Perform a Verification of Payee (VOP) check on bulk payment files, before you submit them for payment.

VOP checks if the name of the person or business matches the name associated with the IBAN, for each payment in your bulk payment file. You should enter the full name (first name, surname, or legal name if an entity) of the payee to ensure the service is carried out effectively. If the payee name provided is a close match, the service will provide the exact account name.

The VOP service should only be used when creating a payee and making payments. It should not be used for any other purpose.

You can opt out of VOP for bulk payment files if you want to. If you have opted out of VOP by not using the service, and make a bulk file payment, and the payment reaches the wrong payee, we may not be able to recover the money. And we will not be liable to you for any losses.

Invitation to VOP

Bulk payment file submitters will receive an email invitation to Verification of Payee (VOP). This email will contain details of how to register for VOP.

Once you have registered your own account on VOP, you can invite additional users to the service. We recommend that you have at least one additional user registered for VOP.

The steps to register for VOP are outlined in the Verification of Payee (VOP) bulk payments tab.

Support videos

VOP bulk file service FAQs

-

How do I log in for the first time?

First, you’ll need an invitation email. It will be sent to you from no-reply@surepay.nl. When you get it, click “Accept invitation” in the email. Follow the setup steps to create a password and set up your Multi-Factor Authentication (MFA) by tapping the “Add Service” icon in your Approve app.

Alternatively, you can use an existing Google or Microsoft authenticator app.

Remember: We will never call, text or email you with a link asking for your one-time activation codes from your Business On Line Approve App. We will never ask for your full online banking login details. If someone asks you for a one-time code from your Approve app, hang up. Contact the Helpdesk immediately. For more information, visit Security Zone on our website.

-

I did not get an invitation email. What should I do?

Request an invitation email for VOP from the Administrator of your Business On Line profile. If you are the registered Administrator on your company’s Business On Line profile and you want to get set up, please contact the BOL Helpdesk to request your invitation email.

Remember: We will never call, text or email you with a link asking for your one-time activation codes from your Business On Line Approve App. We will never ask for your full online banking login details. If someone asks you for a one-time code from your Approve app, hang up. Contact the Helpdesk immediately. For more information, visit Security Zone on our website.

-

My invitation email has expired. How can I get a new one?

Ask your Administrator to resend the invitation. If you are an Administrator and your link has expired, please contact the Helpdesk to request a new invitation.

Remember: We will never call, text or email you with a link asking for your one-time activation codes from your Business On Line Approve App. We will never ask for your full online banking login details. If someone asks you for a one-time code from your Approve app, hang up. Contact the Helpdesk immediately. For more information, visit Security Zone on our website.

-

What is Multi-Factor Authentication (MFA), and how do I set it up?

MFA provides an additional layer of security to Administrators and Users when they access the VOP service. You’ll need an authenticator app like:

- HID Approve (Recommended for existing Business On Line Users)

- Google Authenticator

- Microsoft Authenticator.

You will need to scan the QR code shown during setup, using your chosen MFA app above.

-

What MFA methods are supported?

One-Time Password (OTP) using any supported app – HID Approve, Google or Microsoft Authenticator.

-

I lost my phone or changed devices. How do I reset MFA?

Ask your Administrator to reset your MFA. Once it has been reset, you’ll be prompted to set it up again at your next login.

Remember: We will never call, text or email you with a link asking for your one-time activation codes from your Business On Line Approve App. We will never ask for your full online banking login details. If someone asks you for a one-time code from your Approve app, hang up. Contact the Helpdesk immediately. For more information, visit Security Zone on our website.

-

Can I skip MFA each time I log in?

Yes. Select “Remember this device” during login. This will mean that your device is trusted for 30 days.

-

How do I reset my password?

- Go to the login screen (https://vop.bankofireland.com)

- Click “Forgot password?”

- Enter your email and follow the link sent to your inbox to set a new password.

-

How do I log out of VOP?

Click your profile icon in the top right, and select “Sign out.”

-

How do I know if the Verification of Payee (VOP) invitation email I have received is legitimate?

Invitation emails for the Verification of Payee service will only issue from “no-reply@surepay.nl”. Please verify that the sender email address is correct before clicking on the invite to register.

- Invitation emails are only issued to customers with registered bulk credit transfer payment facilities. If you do not use a bulk credit transfer payment facility then you do not need to register for the Verification of Payee service.

- If you are a User of Business On Line Payments Plus, your Administrator may have invited you to register for the VOP service. If you have received an invitation email, please confirm this with your Administrator before clicking on the invite to complete registration.

Remember: We will never call, text or email you with a link asking for your one-time activation codes from your Business On Line Approve App. We will never ask for your full online banking login details. If someone asks you for a one-time code from your Approve app, hang up. Contact the Helpdesk immediately. For more information, visit Security Zone on our website.

Single IBAN checks

Bulk File IBAN checks

-

What file types are supported for upload?

You can upload files in the following formats:

- Excel (.xlsx)

- CSV (semicolon-separated)

- PAIN.001 XML (version 001.09).

-

How do I upload a file?

You can upload files in the following formats:

- Go to the “File Check” tab

- (Optional) You can download a template file in Excel or CSV format, by clicking the ‘CSV’ or ‘Excel’ hyperlinks found below the upload area

- Click “Browse” or drag and drop your completed file into the upload area.

Wait for the status to show “Processed successfully” or check for error messages.

-

What does “Queued for processing” mean?

It means that your file was successfully uploaded and is waiting to be processed. Once completed, the status will update accordingly.

-

How do I download the result file?

- Once the file is processed, you can find it on the right-hand side of the File Check screen

- Click “Download File”

- Select your preferred format (Excel or CSV)

- The file will be saved to your default download folder.

-

Can I download result files uploaded by colleagues?

Yes. All file checks uploaded by Users within your organisation are visible and available for download.

-

What should I watch for when formatting files?

- Use semicolon (;) as a delimiter in CSV

- Enclose names with special characters in quotation marks – “ ”

- Avoid blank rows or merged cells

- Use UTF-8 encoding for CSV files

- Ensure no formulas or macros are present

- Stick to the defined column structure, even for unused fields.

-

What does a typical Excel/CSV request file include?

- IBAN (mandatory)

- Beneficiary Name.

-

What do the VOP result values mean?

| VOP Response |

What this means |

What you can do |

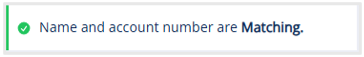

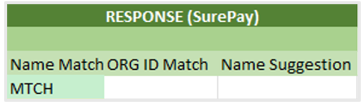

MTCH – Match

Single Payee

Result:

Bulk Payee File

Result:

|

The name you entered matches the name on the account. |

You can continue with the request if you wish.

Before continuing, we recommend checking with the payee that the request for payment is genuine. |

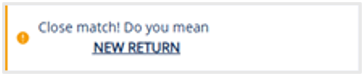

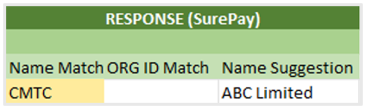

CMTC – Close match

Single Payee

Result:

Bulk Payee File

Result:

|

The payee name provided is a close match but not exactly the same as the name on the account.

The VOP response will provide the exact payee name, so that you can update your records.

|

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

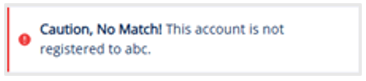

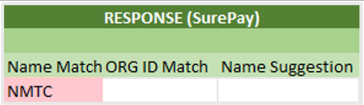

NMTC – No match

Single Payee

Result:

Bulk Payee File

Result:

|

The payee name provided is not the same as the name on the account. |

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

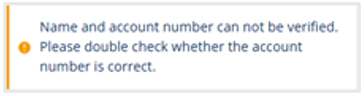

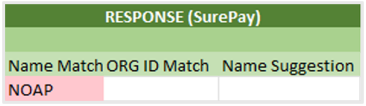

*NOAP or Name and Account number can not be verified

Single Payee

Result:

Bulk Payee File

Result:

|

The details may be correct but they cannot be confirmed at this time. This could be for a number of reasons. For example; a technical issue or the payee bank is not part of VOP. |

We strongly recommend that you confirm the name and account details with the payee before continuing.

Contact the payee, using a trusted phone number.

If you go ahead with the payment, it may be paid to the wrong person or business, and we may not be responsible for your loss. |

*You may see ‘NOAP – Unable to check account details’ or ‘Cannot be checked at the time’ more often as different banks are setting up their VOP service at different times. If the payee’s bank has not set up VOP, it will not be possible for us to confirm the payee’s details before you make the payment.

Important: If you do not get a match when using VOP, only send money if you trust the payee and are sure it is not a scam.

If you proceed with a payment and the name you enter does not match the name associated with the IBAN, we may not be able to recover the money. And we will not be liable to you for any losses.

-

What happens if the whole file fails?

You will see a File-Level Error in the portal. Common reasons include:

- Missing mandatory columns

- Incorrect file structure

- Service downtime.

-

What do I do if only some rows have errors?

These are Row-Level Errors, and a result file will still be generated. Errors will appear in columns such as Error Type, Error Code, and Error Detail.

Common Row-Level Errors & Fixes:

| Error Code |

Description |

Resolution |

| MANDATORY_FIELD_NOT_PROVIDED |

A required field is missing |

Ensure all required fields are filled in |

| INVALID_FIELD |

Field format is incorrect |

Check value format against field rules |

| NAME_TOO_LONG |

Name exceeds character limit |

Trim name to 140 characters |

| MUTUALLY_EXCLUSIVE_FIELDS_USED |

Conflicting fields filled |

Choose either name or organisation ID |

-

What do I do if only some rows have errors?

- 400 – Bad Request: The file is non-compliant. For example, a mandatory column is missing or incorrect delimiters are used. Correct any formatting errors and resubmit. Use the templates provided for the best result.

- 500 – Internal Server Error: Try again later or contact support if it persists.

- 503 – Service Unavailable: Likely maintenance. Wait and re-upload after the window.

- 504 – Gateway Timeout: Technical issue: Retry the upload and contact Bank of Ireland if the problem persists.

-

Can I contact support from the portal?

Yes. Click the “Help” button in the bottom-right corner of the portal for assistance.

VOP Admin

-

Who should have access to VOP?

For security reasons, only people within your business should be given access to the Bank of Ireland VOP service by an authorised Administrator.

-

How do I view or search for a User?

- Log in to the VOP portal as an Administrator

- Click on your Profile name (Top right corner of screen) > Settings > Users

- You will be presented with a screen displaying all the Users currently using the VOP system

- Click on “search” and enter the name or email address of the User.

Note: If you do not see the “Users” option, you do not have the Admin role. Contact your organisation’s Administrator to assign it to you.

-

How do I change a User’s name or role?

- Click on your Profile name (Top right corner of screen) > Settings > Users

- You will be presented with a screen displaying all the users currently using the VOP system – find the User you want to update

- Click on “Edit” or the name of the User

- Update the Name or add/remove roles

- Click “Save changes”.

-

How do I remove a User from VOP?

- Click on your Profile name (Top right corner of screen) > Settings > Users

- You will be presented with a screen displaying all the users currently using the VOP system – find the user you want to remove

- Click on “Remove”

- Confirm by clicking “Yes, remove user”.

A confirmation message will appear at the top of your screen.

-

How do I create a new User?

- Log in to VOP as an administrator

- Click on your Profile name (Top right corner of screen) > Settings > Users.

- Click “Invite New Members”

- Enter the name, email address, and assign roles (for security reasons, only invite Users within your company to the Bank of Ireland VOP service)

- Click “Create user”

- The user will get an invitation by email.

-

How do I view Users who have been invited but haven’t joined yet?

- Log in as an Administrator

- Click on your Profile name (Top right corner of screen) > Settings > Invitations

- You will see any pending invitations

- Once accepted, Users appear in the main “Users” list.

-

How do I revoke a pending invitation?

- Log in as an administrator

- Click on your Profile name (Top right corner of screen) > Settings > Invitations

- Click “Revoke” next to the invited User.

- Confirm by clicking “Yes, revoke invitation”.

The original invitation email will no longer work.