Verification of Payee (VOP) single payments

Verification of Payee (VOP) is a new mandatory security step for all SEPA and SEPA Instant payments.

VOP checks with the receiving bank that the name you enter matches the name of the person or business associated with the IBAN. It will do this when you add a payee or before you authorise a SEPA payment on Business On Line.

The VOP service should only be used when creating a payee and making payments. It should not be used for any other purpose.

To make sure the check works well, please enter the full name of the payee correctly. This means using the first and last name for a person and the legal name for a business. If the name is a close match, VOP will show you the exact account name.

What if the name is not a match?

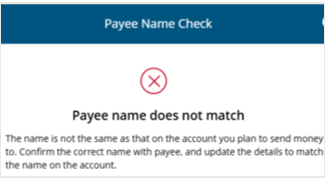

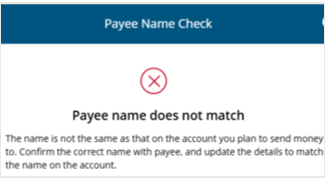

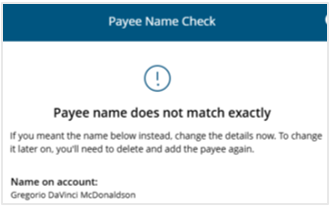

If the name you enter does not match the IBAN, you will see a message that says, ‘Payee name does not match’.

If this happens, check the correct name with the payee before going ahead.

If you send a payment with the wrong name, we may not be able to recover the money and Bank of Ireland will not be liable for any loss.

VOP responses explained

| VOP response |

What it means |

|

Match

|

The name and account details match.

|

|

Close Match

|

Name is not an exact match and the correct name associated with the account will display.

|

|

No Match

|

Name does not match.

|

|

Unable to check payee name*

|

Unable to check account details.

|

*You may see ‘Unable to check payee name’ more often as different banks are setting up their VOP service at different times. If the payee’s bank has not set up VOP, it will not be possible for us to confirm the payee’s details before you make the payment.

VOP single payment FAQs

Please check this page for future updates.

-

What is Verification of Payee (VOP)?

VOP is a new mandatory security step for all SEPA and SEPA Instant payments. VOP checks with the receiving bank that the name you enter matches the name of the person or business associated with the IBAN. It will do this when you add a payee or make a payment or before you authorise a SEPA payment on Business On Line. This will help you to avoid paying the wrong person or business.

-

Business Online VOP responses explained

| VOP Response |

What this means |

What you can do |

Match

|

The name you entered matches the name on the account. |

You can continue with the request if you wish.

Before continuing, we recommend checking with the payee that the request for payment is genuine. |

Close match  |

The payee name provided is a close match but not exactly the same as the name on the account.

The VOP response will provide the exact payee name, so that you can update your records.

|

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

No match

|

The payee name provided is not the same as the name on the account. |

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

Unable to check payee name*

|

The details may be correct but they cannot be confirmed at this time. This could be for a number of reasons. For example; a technical issue or the payee bank is not part of VOP. |

We strongly recommend that you confirm the name and account details with the payee before continuing.

Contact the payee, using a trusted phone number.

If you go ahead with the payment, it may be paid to the wrong person or business, and we may not be responsible for your loss. |

*You may see ‘Unable to check payee name’ more often as different banks are setting up their VOP service at different times. If the payee’s bank has not set up VOP, it will not be possible for us to confirm the payee’s details before you make the payment.

-

What happens if the name and IBAN match?

If the name and IBAN match, you’ll see a message on screen confirming this.

| VOP Response |

What this means |

What you can do |

Match

|

The name you entered matches the name on the account. |

You can continue with the request if you wish.

Before continuing, we recommend checking with the payee that the request for payment is genuine. |

-

What happens if the name and IBAN do not match?

If the name you enter does not match the IBAN, you will see a message that says, ‘Payee name does not match’.

If this happens, check the correct name with the payee before going ahead.

If you go ahead with a payment where the payee name does not match, it may go to the wrong payee. We may not be able to recover the money if this happens. Bank of Ireland will not be liable for any loss.

| VOP Response |

What this means |

What you can do |

No match  |

The payee name provided is not the same as the name on the account. |

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

-

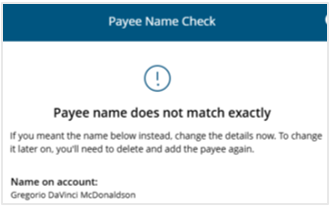

What happens if the name and IBAN are a close match?

If the name you typed in is a close match to the one on the account, but not exactly the same, you’ll see a ‘Payee Name does not match exactly’ screen and the correct name associated with the account. If you are adding a payee you can change the details and update the name to match the one returned.

We advise you to check the name with the payee before continuing with the payee or payment.

If you go ahead with a payment where the payee name does not match, it may go to the wrong payee. We may not be able to recover the money if this happens. Bank of Ireland will not be liable for any loss.

| VOP Response |

What this means |

What you can do |

Close match

|

The payee name provided is a close match but not exactly the same as the name on the account.

The VOP response will provide the exact payee name, so that you can update your records. |

Stop and check with the payee, using a trusted phone number.

You can update a payee name by deleting the existing payee before adding the payee again, using their existing IBAN details with the updated name. If the updated payee name is an exact match to the account details, this will return a “Match” VOP response.

If you go ahead with the payment without updating the payee name, it may be paid to the wrong person or business, and we will not be responsible for your loss. |

-

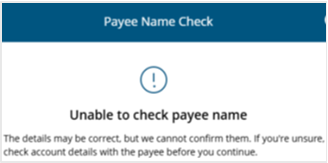

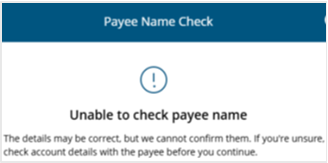

What happens if Bank of Ireland cannot confirm that the details match?

If for any reason we’re unable to confirm that the name and account details match, you’ll see an ‘Unable to check account details’ message on screen. We advise you to check the name with the payee before continuing to create a new payee or make a payment.

If you go ahead with a payment where we are unable to confirm that the details match, it may go to the wrong payee. We may not be able to recover the money if this happens. Bank of Ireland may not be liable for any loss.

You may see ‘Unable to check payee name’ more often as different banks are setting up their VOP service at different times. If the payee’s bank has not set up VOP, it will not be possible for us to confirm the payee’s details before you make the payment.

| Response |

What this means |

What you can do |

Unable to check payee name

|

The details may be correct but they cannot be confirmed at this time. This could be for a number of reasons. For example; a technical issue or the payee bank is not part of VOP. |

We strongly recommend that you confirm the name and account details with the payee before continuing.

Contact the payee, using a trusted phone number.

If you go ahead with the payment, it may be paid to the wrong person or business, and we may not be responsible for your loss. |

-

What happens if I make a payment to the wrong account?

If you proceed with a payment and the name you enter does not match the name associated with the IBAN, we may not be able to recover the money. And we will not be liable to you for any losses.

-

Making a payment to a joint account

If you’re making a payment to a joint account, VOP will tell you if the name you enter matches at least one of the account holders. We advise you to check the name with the payee, before continuing with the payee or payment.

-

Receiving SEPA payments

When providing your bank details for receiving SEPA payments, always provide your full and correct name (not a nickname) or the legal or trading name of your business.

-

Is it mandatory to complete Verification of Payee (VOP)?

Yes, under the SEPA regulation, we must carry out VOP for all SEPA payments and SEPA Instant payments. If you use the bulk file service, you will be able to opt out of VOP (for bulk files only). Visit Verification of Payee (VOP) for bulk payments for more.

-

When can I submit a Verification of Payee (VOP) request?

When you add a payee or make a SEPA payment or SEPA Instant payment, we will check that the name of the payee you have entered matches the IBAN you have included, before you authorise the payment.

-

Is it important that people have my correct account details?

Yes. This means the correct IBAN and your full and correct name (not a nickname) or the legal or trading name of your business. Remember to let payers know if your details change.

-

Is it important that I have the correct account details for people I want to pay?

Yes. This means the correct IBAN, and the full and correct name (not a nickname) or the legal or trading name of the business. Check that the request for payment is genuine. Confirm the details directly with someone you know and trust.

Note: You may see ‘Unable to check payee name’ more often as different banks are setting up their VOP service at different times. If the payee’s bank has not set up VOP, it will not be possible for us to confirm the payee’s details before you make the payment.

-

What are some of the telltale signs of fraud?

Some telltale signs of fraud are:

- Changes to account details

- A sense of urgency to make a payment

- Somebody advising you to accept a “close match” or “does not match” without verifying

- A deal that sounds too good to be true.

For more information, please visit Security Zone.